Trading into the Future - Weekly Analysis - XAU/USD - DXY - GU

Sangev • 2023-08-07

Weekly Market Forecast - August 7th

August Week 1 - The Wind Blows Strong

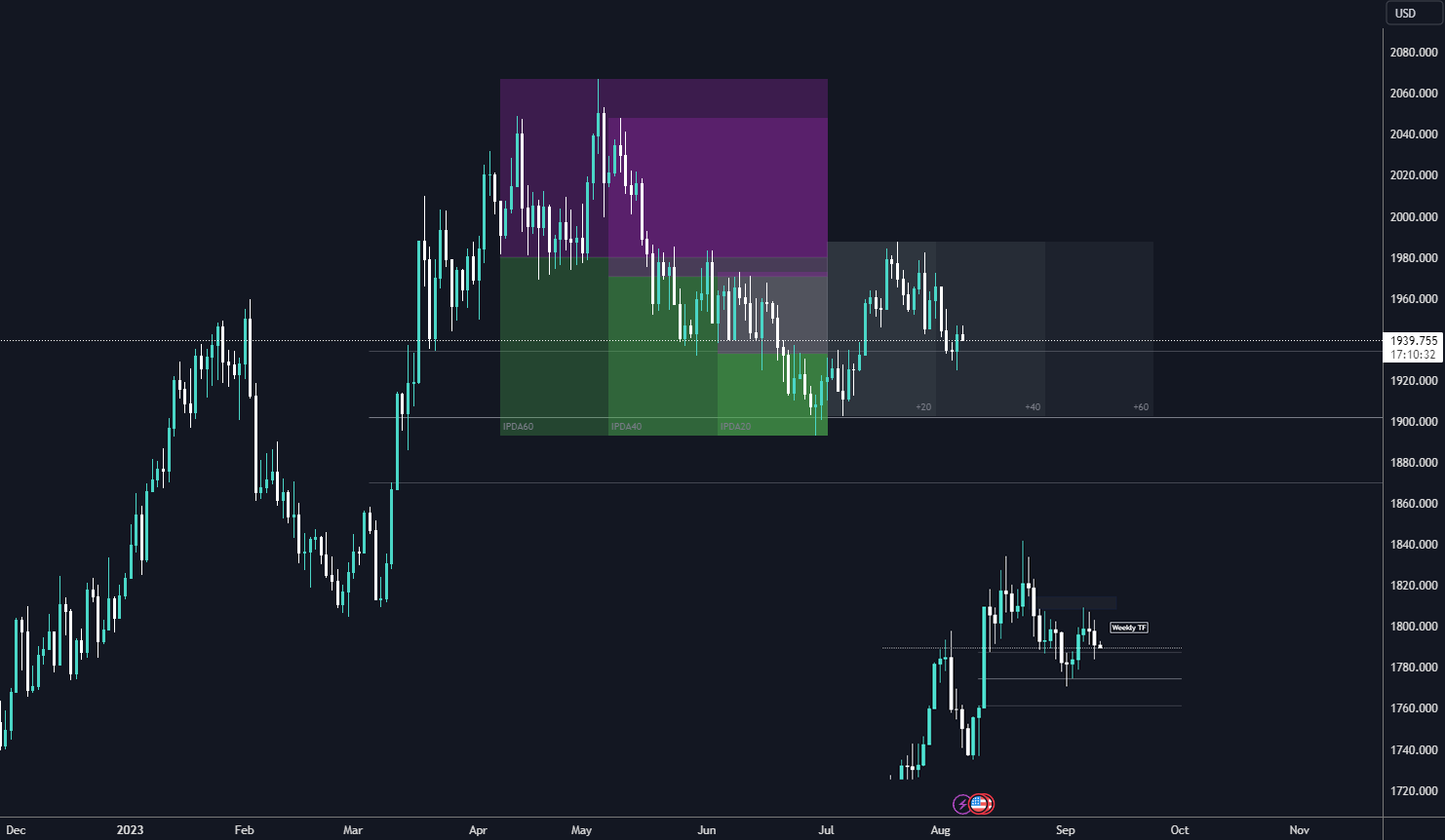

XAU/USD - Gold Tele Rings

Let’s breakdown what this chart means to me and what I see coming into this week.

The previous 20-day cycle was beautiful, as the price soared to our expected area of liquidity and broke through the accumulated regions of liquidity. When we reach such a significant level of liquidity, it often takes multiple attempts to move out of the zone in the opposite direction. A study on this will be presented on this blog soon, but for now, you must see it visually for yourself.

Hint: See the triple consistent HL’s posted before the move down?

In the photo above I’ve placed the CE for the FVG that was previously respected on the weekly timeframe. If we look to the left of the daily chart we can see this is where the FTR was formed and respected it as well - beautiful. When looking at the next 20 day cycle, the available liquidity for us to go through is below 1900 region. The only counter-argument to this perspective is that we may be in a market maker model:

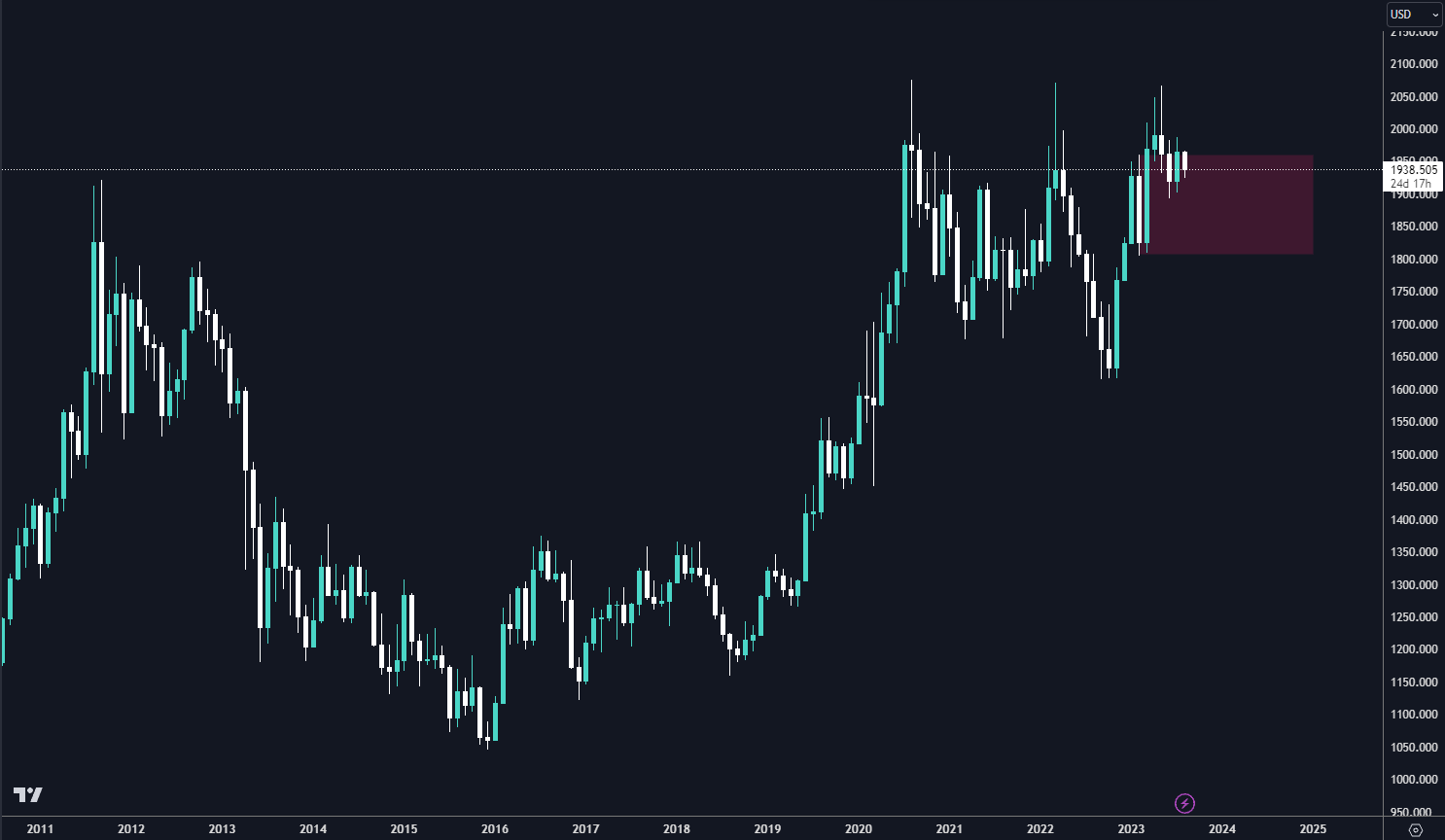

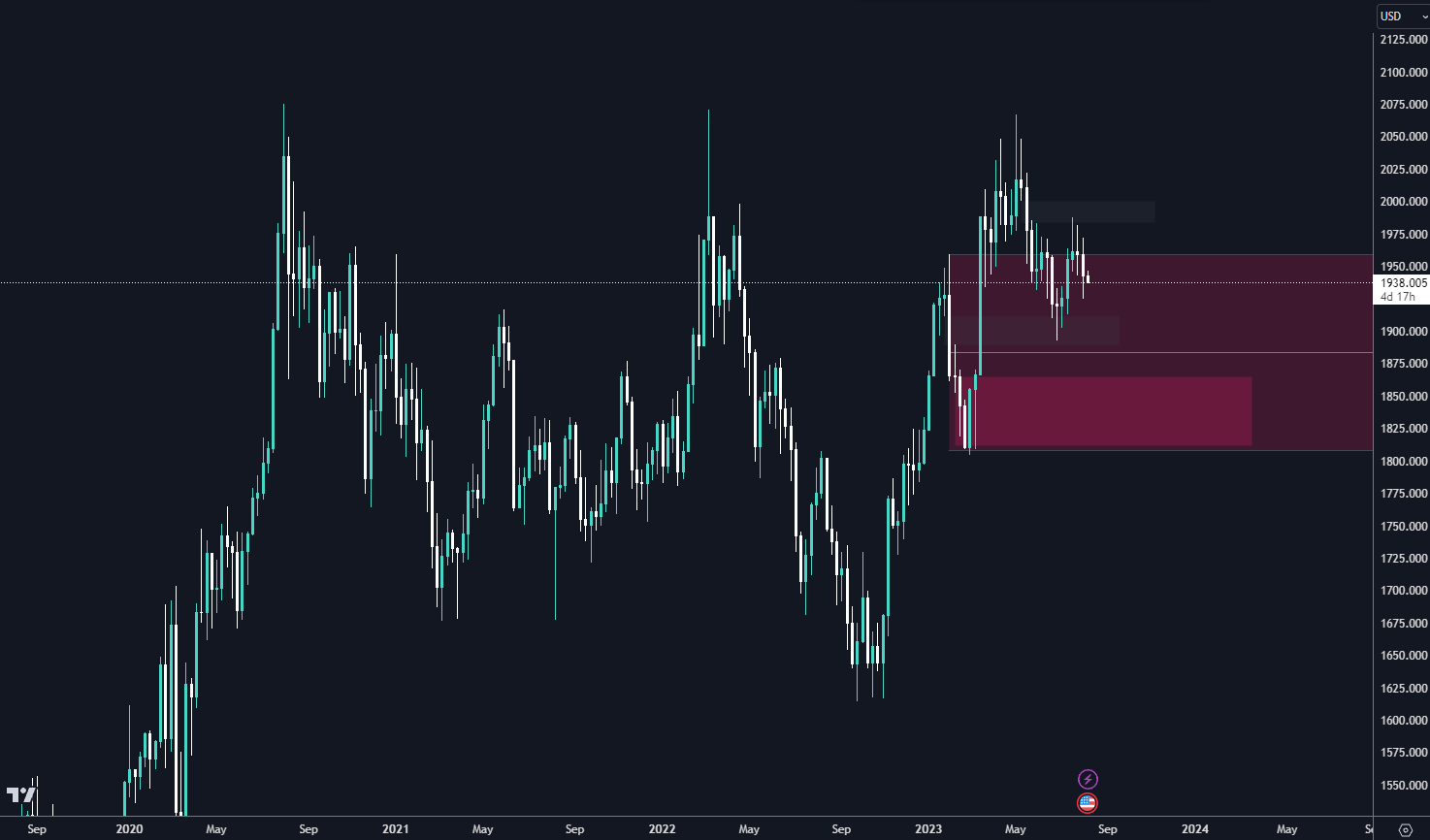

When I look at the monthly TF it gives me a bullish bias because we’ve formed an FTR prior to the zone and the previous month showed respect for it by closing bullish. This would be an area of interest for bullish setups.

We must position ourselves accordingly - even though we have a balanced price range it is possible for there to a break below this area and into the 1850’s region as this was the last posted OB before the push up into the 2000’s

Overall I will wait for today to play out and see how price reacts to the LTF liquidity regions before placing any orders. There is contradictory analysis which means we must be careful with any entries right now until further market confirmation.

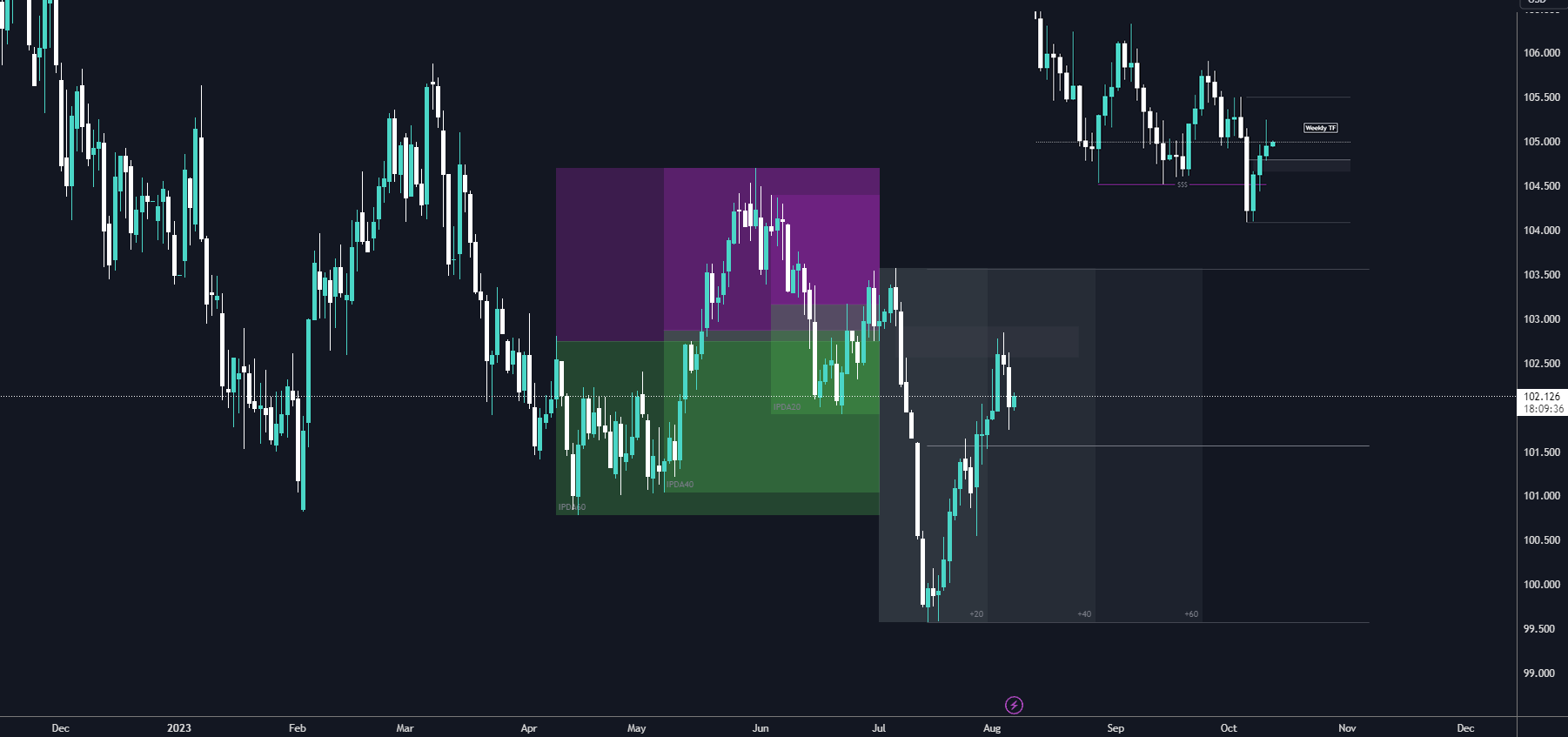

DXY - the father of movement

Similar to how gold broke through the weekly levels of liquidity, we can see how DXY did the same for the accumulated regions of liquidity highlighted above. There is an obvious imbalance presented on the weekly chart, and we have recently fulfilled one on the closure of last week.

I anticipate a pullback to offer more long positions, but also to rebalance the weekly FVG that was created in the 101.5 region. A tap back into the area is highly possible before we get clear indication of movement.

Similar to Gold, the analysis of the daily timeframe contradicts the monthly timeframe, as the accumulation present in the months has showcased a possibility for a large drop.

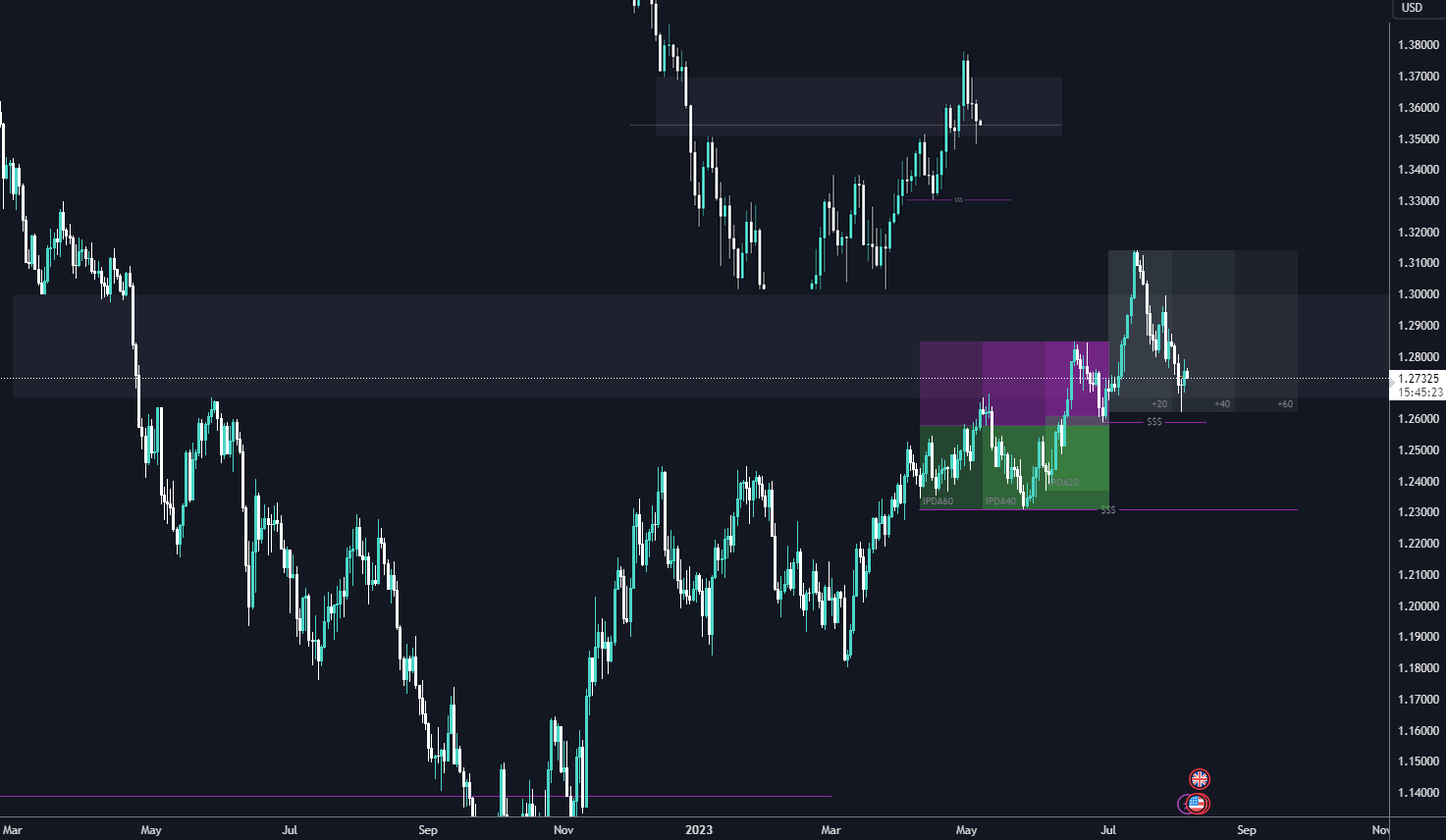

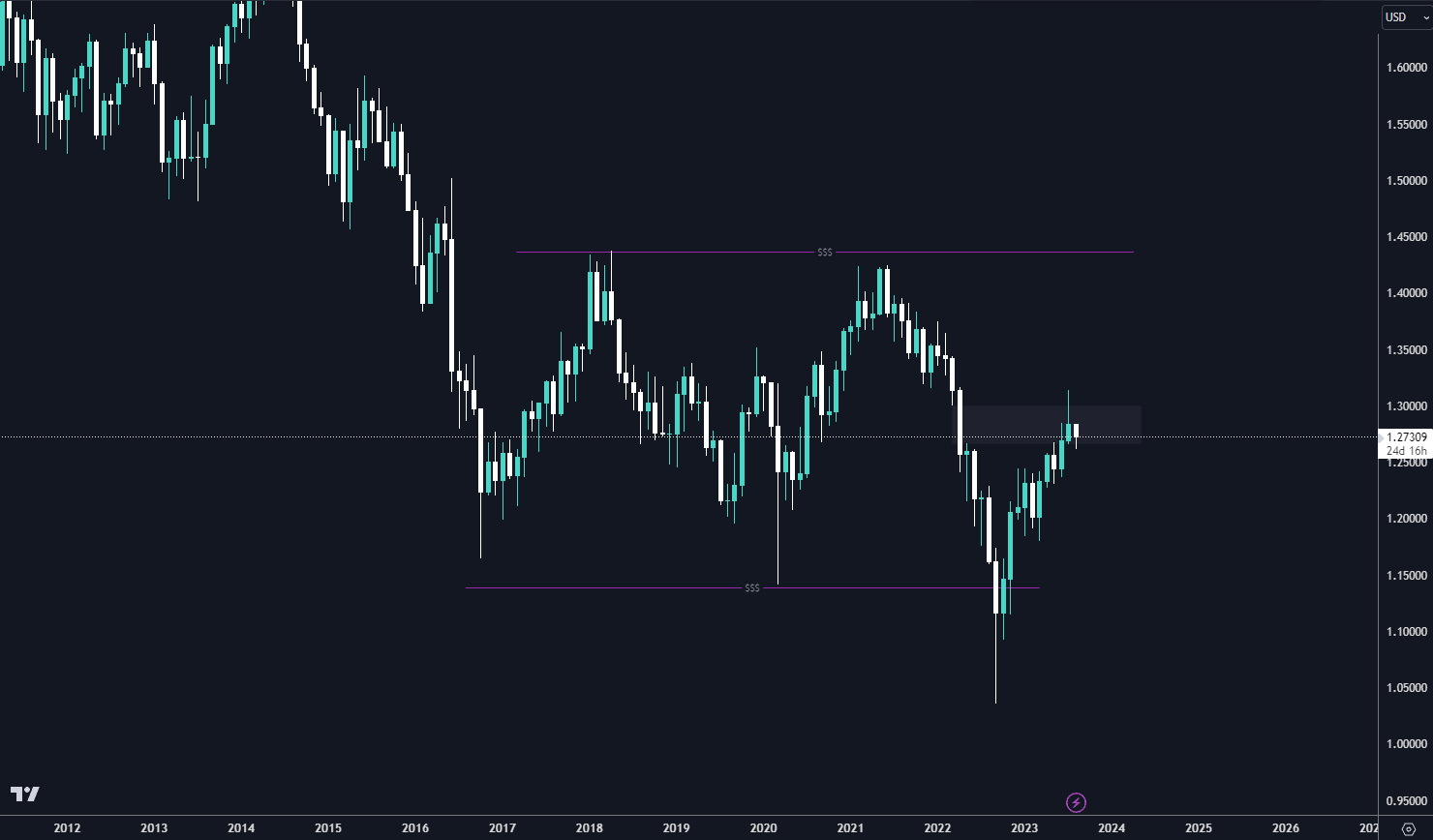

GU - Clean FX

GU has wiped out the highs from the previous cycles - during the liquidity purge we also rebalanced an FVG on the monthly TF.

The relative equal highs presented to us is promising as it offers a strong area of interest for price to move to as we went to ATL’s and rinsed all sellside liquidity. It is the next area of interest, and we can see that there has been lots of accumulation of orders to the FTRs being printed.

We must be weary of a drop to take out all the previous daily cycle lows before pushing up. It is the obvious move as we’ve just rebalanced.

See More Posts

Cardy

Copyright © 2021 Govest, Inc. All rights reserved.