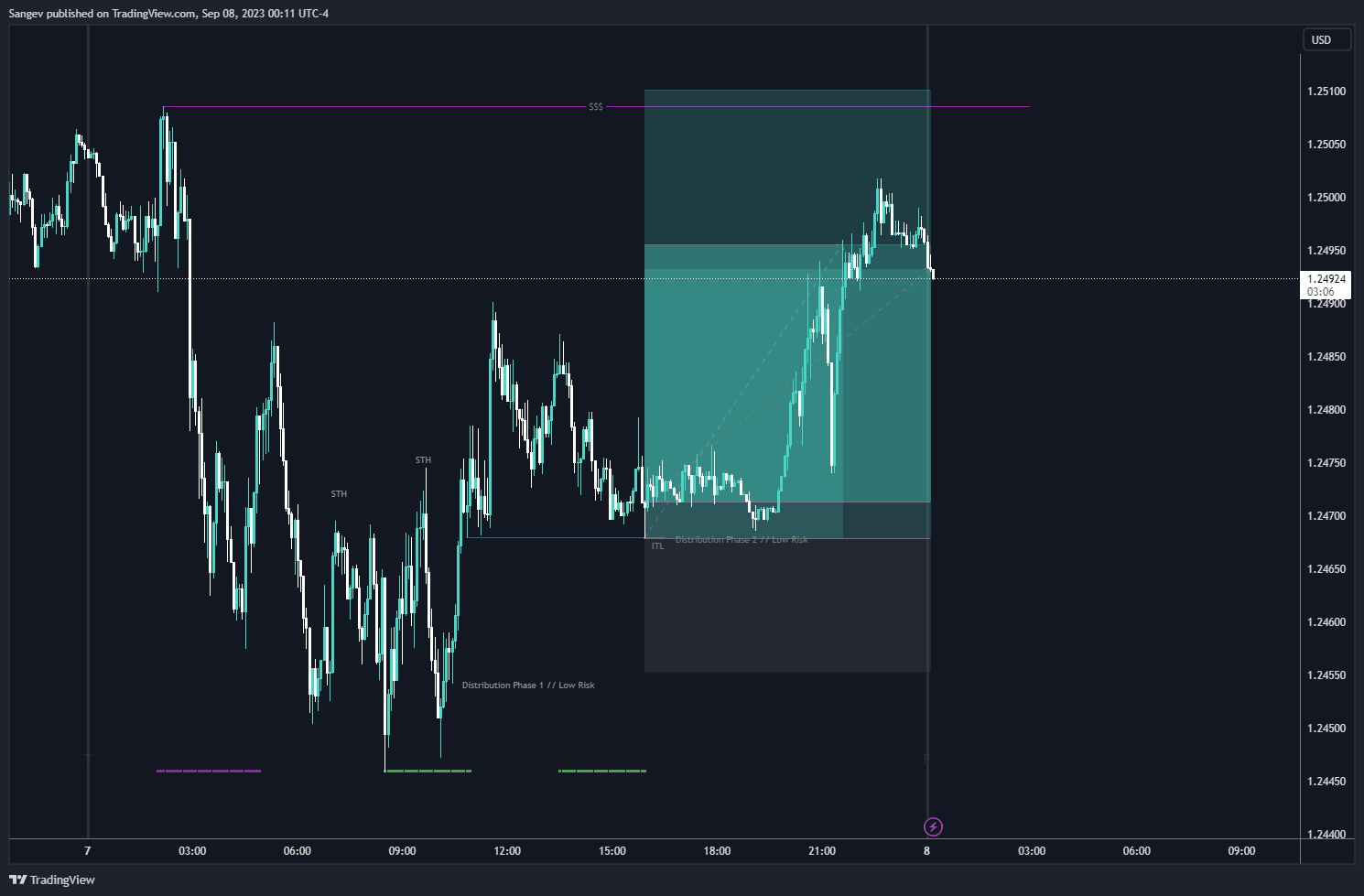

GBPUSD - Distribution Phase 2

Sangev • 2023-09-08

GBPUSD Trade taken this week - High Probability

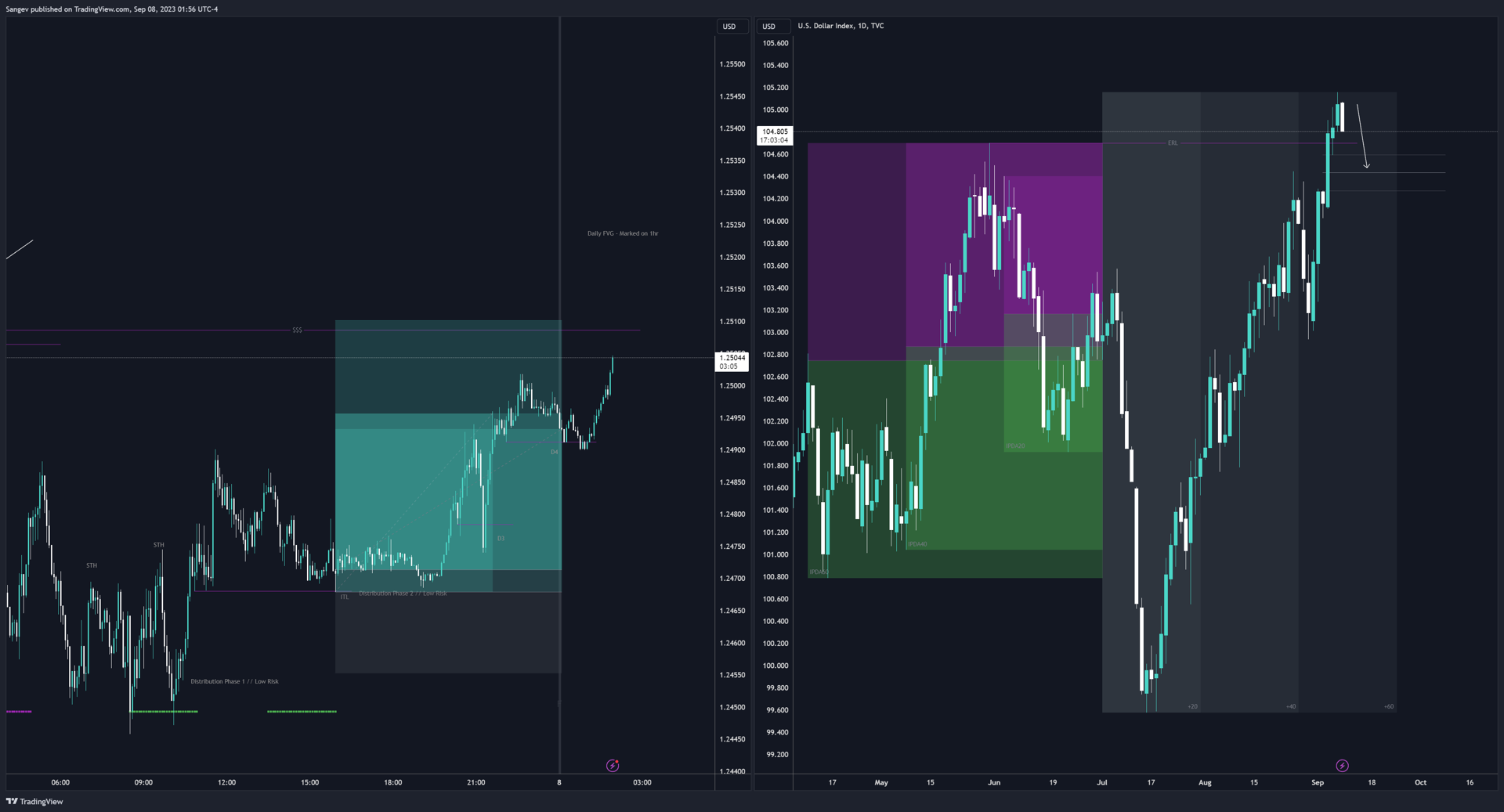

DXY - Bearish Outlook → GBPUSD BULLISH

We see the IPDA ranges getting taken out on the major cycles - we therefore anticipate a response of a bearish price action as the algo only:

- Reprices

- Seeks new High’s and Low’s

GBPUSD

Similar situation but reverse, except this wasn’t major highs or lows. Priced tapped into an OB after taking out an old LH created in the IPDA 20 range during the June-July cycle.

We therefore anticipate bullish price action to reprice, and the FVG created as we broke down is the perfect area to rebalance.

There are multiple areas for us to take profits as and to hold, but by increasing the amount of PD Arrays price must break through in-order to reach a TP → it reduces the overall potential of us getting to our target.

By lowering where we have our TP, it increases significantly not only our hit rate - but overall win rate too.

A broken down analysis + killzone times to give insight on perspective and how this was traded. If there was no opportunity during KZ no trade would’ve been taken. If price breaks past any bullish PD arrays I will be closing the position. All up-closed candles should be respected. If broken past - there is a shift in MS - which reduces risk of TP being hit.

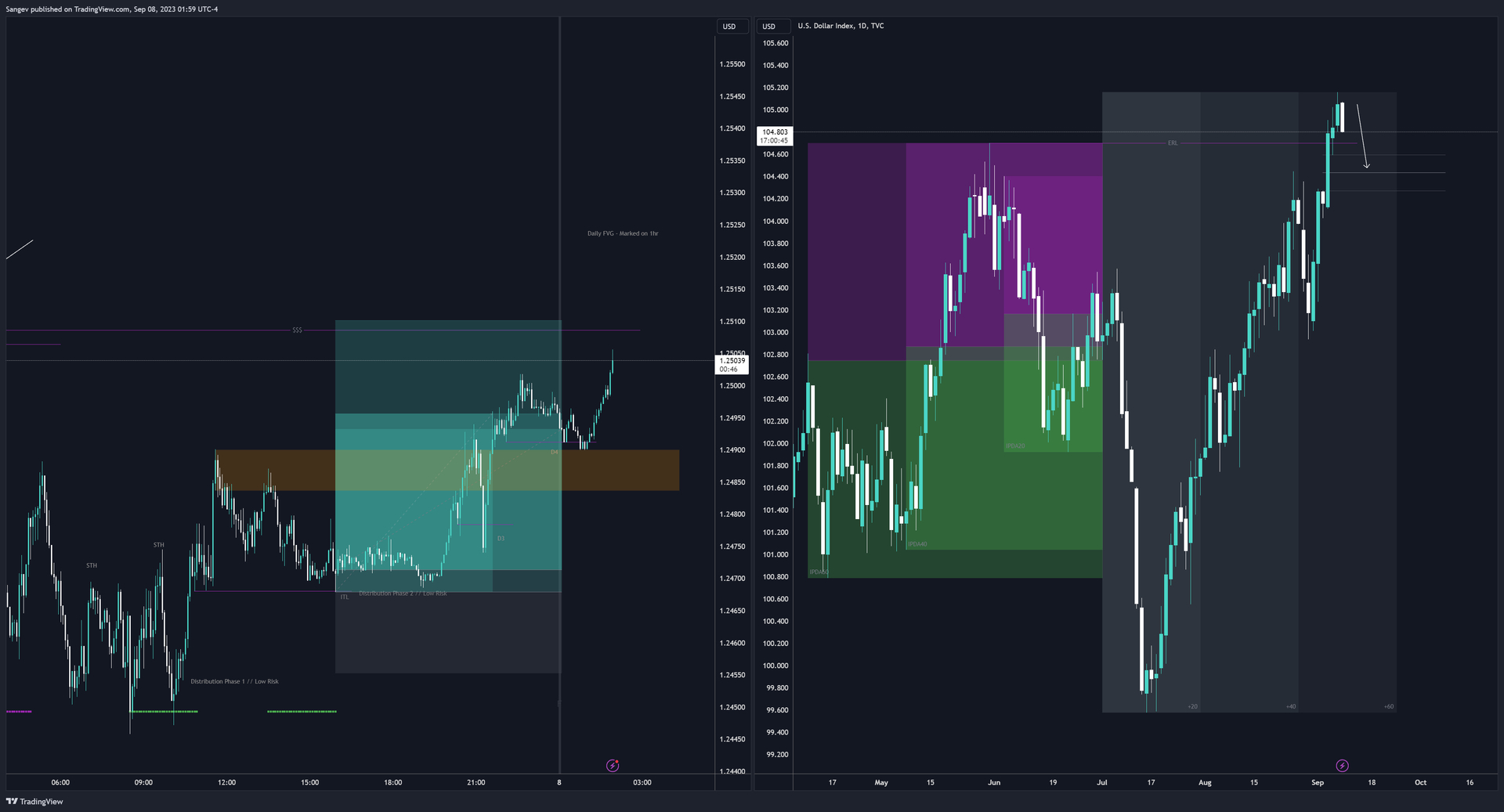

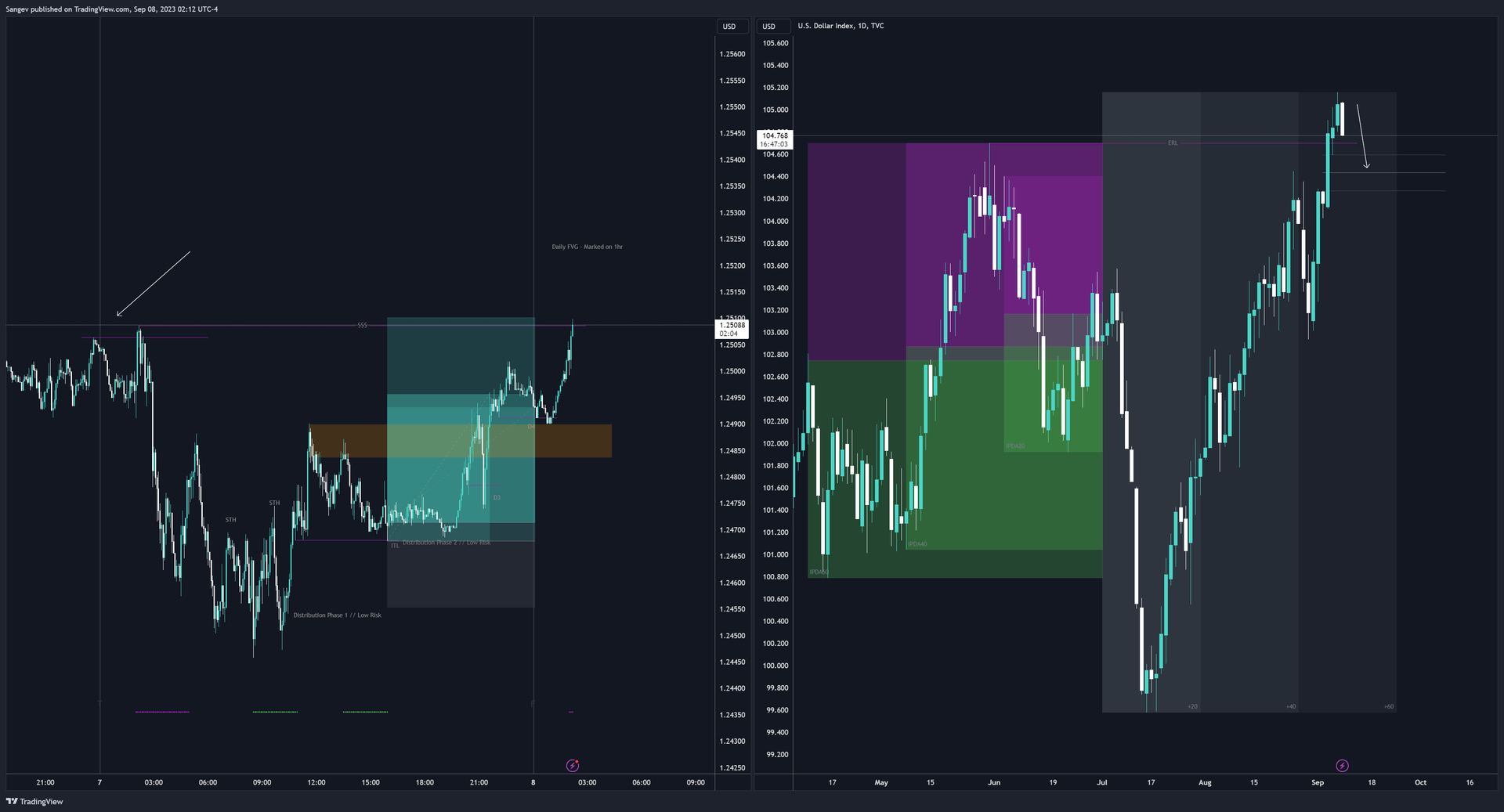

Closed the position here for 2R - price was breaking past bullish PD arrays which indicates a MSS.

Closed prior to London KZ / True day open. Interesting as when we reflect back - not all “down closed” candles were respected, but the PD arrays around them were. Highlighted below is the breaker candle.

Price respected the breaker to the PIP

Onto the next! MMXM complete.

See More Posts

Cardy

Copyright © 2021 Govest, Inc. All rights reserved.